All Categories

Featured

Table of Contents

Maintaining all of these phrases and insurance coverage types straight can be a migraine. The following table places them side-by-side so you can rapidly differentiate among them if you get puzzled. Another insurance policy coverage type that can pay off your home loan if you die is a basic life insurance coverage plan

A remains in area for an established number of years, such as 10, 20 or thirty years, and pays your recipients if you were to die throughout that term. A supplies coverage for your whole life span and pays when you pass away. As opposed to paying your mortgage loan provider straight the way home loan protection insurance coverage does, conventional life insurance plans most likely to the recipients you pick, that can after that choose to repay the home mortgage.

One common policy of thumb is to intend for a life insurance plan that will certainly pay out as much as ten times the insurance policy holder's income quantity. Conversely, you may pick to make use of something like the dollar approach, which includes a household's financial obligation, earnings, mortgage and education costs to determine just how much life insurance policy is needed (life insurance and mortgage insurance).

It's also worth keeping in mind that there are age-related limits and limits enforced by almost all insurers, who frequently won't offer older purchasers as many options, will certainly charge them extra or might deny them outright.

Below's just how home mortgage protection insurance policy measures up versus typical life insurance coverage. If you're able to get approved for term life insurance policy, you must avoid home mortgage defense insurance policy (MPI). Compared to MPI, life insurance policy offers your family a less expensive and extra flexible benefit that you can count on. It'll pay out the exact same quantity anytime in the term a fatality occurs, and the cash can be made use of to cover any kind of expenses your family members regards needed during that time.

In those situations, MPI can give fantastic tranquility of mind. Simply be certain to comparison-shop and check out all of the fine print before signing up for any kind of plan. Every mortgage protection alternative will have various rules, policies, benefit choices and downsides that need to be weighed meticulously versus your accurate situation (do i have to have life insurance with a mortgage).

Mortgage Protect Canada

A life insurance policy policy can help pay off your home's mortgage if you were to die. It is just one of lots of means that life insurance coverage may aid shield your enjoyed ones and their economic future. One of the very best methods to factor your home loan into your life insurance coverage requirement is to talk with your insurance representative.

Rather of a one-size-fits-all life insurance coverage policy, American Domesticity Insurer supplies policies that can be developed particularly to satisfy your family members's requirements. Here are several of your choices: A term life insurance coverage plan. sfg mortgage protection is active for a details quantity of time and commonly supplies a larger quantity of coverage at a lower cost than an irreversible policy

Rather than just covering a set number of years, it can cover you for your entire life. It additionally has living benefits, such as money worth accumulation. * American Family Members Life Insurance coverage Business offers different life insurance coverage plans.

Your agent is a fantastic source to answer your inquiries. They may also be able to assist you discover spaces in your life insurance policy protection or brand-new methods to save on your various other insurance plan. ***Yes. A life insurance beneficiary can select to utilize the fatality advantage for anything - best mortgage protection insurance. It's a fantastic means to aid protect the monetary future of your family if you were to die.

Life insurance is one method of aiding your family members in paying off a mortgage if you were to pass away prior to the home mortgage is completely repaid. Life insurance profits may be utilized to help pay off a mortgage, but it is not the same as home mortgage insurance policy that you may be needed to have as a problem of a finance.

Is Mortgage Protection Necessary

Life insurance may assist ensure your residence remains in your family by offering a fatality advantage that might help pay for a mortgage or make crucial acquisitions if you were to die. Call your American Household Insurance coverage representative to talk about which life insurance policy plan best fits your demands. This is a short summary of insurance coverage and is subject to policy and/or motorcyclist terms, which may differ by state.

The words lifetime, lifelong and irreversible are subject to policy terms. * Any finances drawn from your life insurance policy will certainly accumulate interest. mortgage protection insurance online. Any impressive finance equilibrium (finance plus passion) will be deducted from the survivor benefit at the time of case or from the cash money worth at the time of surrender

Discounts do not use to the life policy. Policy Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

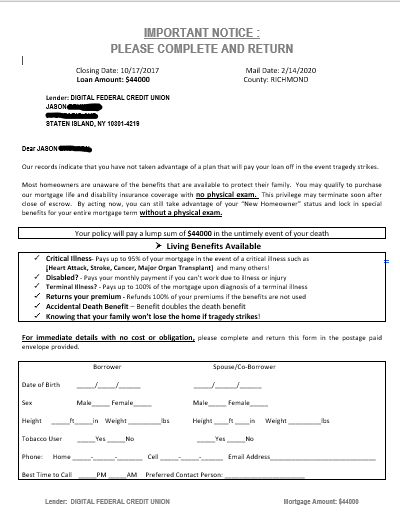

Home loan security insurance policy (MPI) is a different kind of protect that could be helpful if you're not able to settle your mortgage. Home mortgage protection insurance coverage is an insurance policy that pays off the rest of your mortgage if you pass away or if you come to be impaired and can not function.

Like PMI, MIP shields the loan provider, not you. Nonetheless, unlike PMI, you'll pay MIP for the duration of the lending term, in many cases. Both PMI and MIP are needed insurance protections. An MPI policy is totally optional. The quantity you'll pay for home loan security insurance depends on a range of elements, consisting of the insurance firm and the present equilibrium of your mortgage.

Still, there are pros and cons: A lot of MPI policies are provided on a "assured acceptance" basis. That can be beneficial if you have a wellness condition and pay high prices permanently insurance coverage or struggle to obtain coverage. is homeowners insurance same as mortgage insurance. An MPI policy can offer you and your family members with a feeling of safety and security

What Is Mortgage Life Insurance Cover

It can likewise be useful for people who do not qualify for or can not manage a traditional life insurance policy plan. You can pick whether you require home mortgage protection insurance and for the length of time you need it. The terms normally range from 10 to 30 years. You could desire your mortgage protection insurance term to be close in length to the length of time you have actually delegated settle your home loan You can cancel a home mortgage defense insurance plan.

Latest Posts

Senior Citizens Funeral Insurance

Aarp Burial Policy

Life Insurance Funeral Expenses