All Categories

Featured

Table of Contents

Nonetheless, maintaining all of these phrases and insurance policy types straight can be a headache - mortgage life and disability insurance state farm. The following table puts them side-by-side so you can swiftly separate amongst them if you get puzzled. An additional insurance protection type that can pay off your home mortgage if you pass away is a basic life insurance policy policy

A remains in place for a set variety of years, such as 10, 20 or 30 years, and pays your recipients if you were to pass away throughout that term. A gives coverage for your entire life span and pays when you pass away. Rather of paying your home loan loan provider directly the way home loan protection insurance coverage does, basic life insurance policy plans most likely to the beneficiaries you select, that can then select to repay the home mortgage.

One usual regulation of thumb is to aim for a life insurance policy that will certainly pay approximately 10 times the insurance holder's income amount. You could select to use something like the Cent approach, which adds a household's financial obligation, income, home loan and education and learning expenses to compute just how much life insurance policy is needed.

It's likewise worth keeping in mind that there are age-related limitations and thresholds imposed by nearly all insurers, that commonly will not provide older buyers as several options, will certainly charge them more or may reject them outright.

Right here's exactly how home loan defense insurance coverage gauges up versus standard life insurance policy. If you're able to qualify for term life insurance coverage, you ought to prevent home loan security insurance coverage (MPI). Contrasted to MPI, life insurance provides your household a less expensive and much more adaptable benefit that you can trust. It'll pay out the same quantity no matter when in the term a death happens, and the cash can be used to cover any type of expenses your family members deems needed during that time.

In those scenarios, MPI can supply fantastic comfort. Simply make certain to comparison-shop and read all of the great print prior to signing up for any plan. Every mortgage defense choice will have many guidelines, regulations, advantage options and downsides that require to be considered thoroughly against your precise scenario (what is mortgage insurance used for).

Should I Get Life Insurance On My Mortgage

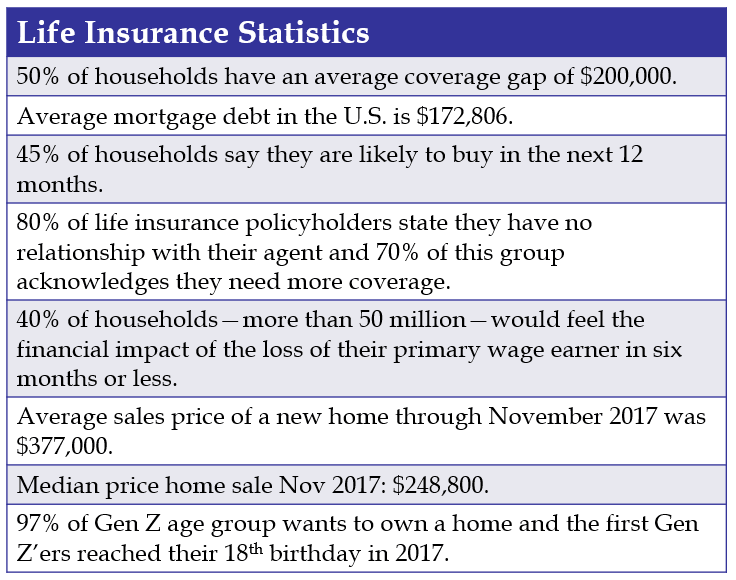

A life insurance coverage plan can aid pay off your home's home mortgage if you were to die. It is just one of lots of manner ins which life insurance policy may assist protect your enjoyed ones and their monetary future. Among the most effective ways to factor your home loan into your life insurance policy requirement is to chat with your insurance representative.

As opposed to a one-size-fits-all life insurance policy, American Family members Life Insurance Company uses plans that can be designed particularly to meet your household's needs. Right here are some of your options: A term life insurance policy. death insurance on home loan is active for a certain quantity of time and commonly uses a larger amount of coverage at a lower cost than an irreversible policy

Instead than just covering an established number of years, it can cover you for your whole life. It likewise has living benefits, such as money value accumulation. * American Family Life Insurance coverage Company provides various life insurance coverage policies.

They might also be able to aid you locate gaps in your life insurance policy coverage or new means to conserve on your various other insurance policies. A life insurance coverage beneficiary can pick to make use of the fatality benefit for anything.

Life insurance policy is one method of aiding your family members in repaying a home mortgage if you were to die prior to the home loan is completely paid back. No. Life insurance is not compulsory, yet it can be a vital part of aiding make sure your liked ones are economically shielded. Life insurance policy earnings might be used to assist settle a home mortgage, yet it is not the like home loan insurance that you could be called for to have as a problem of a loan.

Mortgage And Life Insurance Uk

Life insurance may aid guarantee your house stays in your household by offering a death benefit that might assist pay down a home mortgage or make crucial purchases if you were to pass away. This is a quick description of protection and is subject to policy and/or rider terms and problems, which may vary by state.

Words life time, lifelong and irreversible go through plan conditions. * Any kind of fundings drawn from your life insurance policy plan will accrue passion. home life insurance policy. Any type of superior finance equilibrium (financing plus passion) will be subtracted from the fatality advantage at the time of case or from the cash worth at the time of abandonment

** Topic to policy terms and conditions. ***Discount rates might vary by state and firm financing the auto or home owners plan. Discount rates might not relate to all coverages on a vehicle or home owners policy. Discounts do not apply to the life policy. Plan Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Home loan defense insurance (MPI) is a different type of safeguard that can be handy if you're unable to settle your home mortgage. Home loan defense insurance is an insurance plan that pays off the remainder of your mortgage if you pass away or if you come to be handicapped and can not work.

Like PMI, MIP secures the loan provider, not you. However, unlike PMI, you'll pay MIP throughout of the loan term, in a lot of instances. Both PMI and MIP are called for insurance protections. An MPI policy is completely optional. The quantity you'll spend for home mortgage defense insurance coverage depends upon a selection of variables, consisting of the insurance company and the present equilibrium of your mortgage.

Still, there are pros and disadvantages: Most MPI plans are issued on a "ensured acceptance" basis. That can be useful if you have a wellness condition and pay high prices permanently insurance policy or struggle to obtain coverage. first time buyer life insurance. An MPI plan can provide you and your household with a feeling of safety

Life Insurance Mortgage Protection Cover

You can choose whether you need mortgage security insurance and for exactly how long you need it. You might desire your home loan protection insurance term to be close in length to just how long you have actually left to pay off your home mortgage You can terminate a mortgage defense insurance coverage policy.

Latest Posts

Senior Citizens Funeral Insurance

Aarp Burial Policy

Life Insurance Funeral Expenses