All Categories

Featured

Table of Contents

- – What is a simple explanation of Trust Planning?

- – Term Life

- – What is the best Estate Planning option?

- – Why do I need Policyholders?

- – How do I apply for Life Insurance Plans?

- – How do I apply for Mortgage Protection?

- – What does Whole Life Insurance cover?

- – Why do I need Beneficiaries?

- – How much does Flexible Premiums cost?

Adolescent insurance may be offered with a payor advantage biker, which offers forgoing future costs on the youngster's policy in case of the death of the individual that pays the costs. Elderly life insurance policy, often referred to as rated survivor benefit strategies, offers qualified older candidates with minimal whole life coverage without a clinical evaluation.

These policies are usually much more expensive than a totally underwritten plan if the person qualifies as a typical danger. This type of coverage is for a tiny face quantity, usually purchased to pay the interment expenses of the guaranteed.

These policies can be a financial resource you can make use of if you're diagnosed with a protected ailment that's taken into consideration chronic, essential, or terminal. Life insurance coverage plans fall into 2 classifications: term and long-term.

The 3 most typical sorts of are whole, universal, and variable. Unlike term life, whole life insurance policy doesn't have an expiration day. Furthermore, a part of the premiums you pay into your whole life plan builds cash money worth gradually. Some insurance provider supply little whole life policies, usually described as.

What is a simple explanation of Trust Planning?

Today, the price of an average term life insurance for a healthy 30-year-old is approximated to be around $160 annually simply $13 a month. 1While there are a great deal of variables when it pertains to just how much you'll spend for life insurance policy (plan type, benefit amount, your line of work, and so on), a plan is most likely to be a great deal more economical the younger and much healthier you go to the time you acquire it.

Recipients can usually get their cash by check or digital transfer. Additionally, they can likewise pick just how much cash to receive. They can receive all the money as a lump sum, by way of an installation or annuity plan, or a maintained asset account (where the insurance policy company acts as the financial institution and enables a recipient to write checks versus the equilibrium).3 At Freedom Mutual, we know that the decision to get life insurance policy is an important one.

Term Life

Every effort has been made to guarantee this info is current and proper. Info on this page does not ensure enrollment, advantages and/or the capacity to make changes to your benefits.

Age decrease will apply during the pay period including the covered person's relevant birthday. VGTLI Age Decrease Age of Staff Member Amount of Insurance 65 65% 70 40% 75 28% 80 20% Recipients are the person(s) assigned to be paid life insurance policy advantages upon your death. Recipients for VGTLI are the very same when it comes to GTLI.

What is the best Estate Planning option?

This advantage might be proceeded up until age 70. You have 30 days from your retirement date to choose this coverage using one of the 2 alternatives listed below.

Succeeding quarterly premiums in the quantity of $69 are due on the first day of the complying with months: January, April, July and October. A premium due notification will be sent to you around 30 days before the following due day.

You have the option to pay online using an eCheck or credit/debit card. Please note that service fee may apply. You likewise have the alternative to mail a check or money order to the below address: The Ohio State UniversityAccounts ReceivablePO Box 182905Columbus, OH 43218-2905 Costs rates for this program are subject to alter.

You need to call human resources Connection to stop retired person protection and your costs or to re-enroll if you become disqualified as a staff member and satisfy all other senior citizen eligibility requirements. may transform insurance coverage to a private life insurance policy plan within 31 days of your retired life date. Premium quantities are identified by and paid to the life insurance coverage supplier.

Why do I need Policyholders?

If you retire after age 70, you might transform your GTLI insurance coverage to a specific life insurance coverage plan (as much as $200,000 optimum). Premium amounts are figured out by and paid to the life insurance coverage supplier. Additionally, you are qualified for the university-provided post-retirement life insurance advantage listed below. An university offered post-retirement life insurance benefit is readily available to professors and staff that have one decade of continuous Ohio State service in at least a 50 percent FTE regular appointment at the time of retired life.

The benefit quantity is based on your years of employment in a qualified visit at the time of retirement and is payable to your recipient(-ies) as follows: $2,000 $3,000 $4,000 $5,000 This is planned to be an introduction. In the event the info on these web pages varies from the Plan Record, the Plan Record will certainly govern.

Term life insurance policy policies expire after a particular number of years. Irreversible life insurance policy policies stay active up until the insured individual dies, quits paying premiums, or surrenders the policy. A life insurance coverage plan is only as good as the economic toughness of the life insurance coverage firm that provides it.

Complete what these prices would more than the next 16 or so years, include a little a lot more for inflation, which's the fatality benefit you might intend to buyif you can manage it. Interment or final cost insurance policy is a sort of permanent life insurance policy that has a small fatality advantage.

How do I apply for Life Insurance Plans?

Lots of variables can influence the expense of life insurance policy premiums. Specific things might be past your control, yet other requirements can be handled to possibly lower the cost before (and even after) using. Your health and wellness and age are the most important factors that establish cost, so purchasing life insurance as quickly as you require it is usually the best strategy.

If you're found to be in much better health and wellness, after that your premiums might reduce. You may additionally have the ability to buy extra insurance coverage at a reduced price than you initially did. Investopedia/ Lara Antal Think of what expenditures would certainly require to be covered in case of your fatality. Think about things such as home mortgage, university tuition, charge card, and various other financial obligations, in addition to funeral expenses.

There are valuable tools online to compute the round figure that can satisfy any potential expenses that would certainly need to be covered. Life insurance policy applications typically require individual and family case history and beneficiary details. You might require to take a medical examination and will certainly need to divulge any kind of preexisting medical conditions, history of moving infractions, DUIs, and any hazardous hobbies (such as automobile racing or skydiving).

Due to the fact that females statistically live much longer, they generally pay reduced prices than males of the same age. An individual that smokes goes to risk for many wellness concerns that might shorten life and rise risk-based premiums. Medical tests for many policies consist of screening for health conditions such as heart problem, diabetes mellitus, and cancer cells, plus relevant medical metrics that can suggest health risks.: Dangerous professions and hobbies can make premiums much more costly.

How do I apply for Mortgage Protection?

A history of relocating infractions or driving under the influence can significantly increase the cost of life insurance policy costs. Typical kinds of recognition will likewise be required prior to a plan can be written, such as your Social Protection card, vehicle driver's certificate, or U.S. ticket. When you have actually set up every one of your essential details, you can gather multiple life insurance policy estimates from various carriers based on your research study.

Since life insurance premiums are something you will likely pay month-to-month for years, locating the plan that best fits your needs can conserve you an enormous quantity of cash. It provides the firms we have actually found to be the ideal for different types of demands, based on our research of almost 100 providers.

Below are several of the most crucial functions and defenses supplied by life insurance policy policies. The majority of people utilize life insurance to supply cash to recipients who would endure financial hardship upon the insured's fatality. However, for well-off individuals, the tax obligation benefits of life insurance policy, consisting of the tax-deferred development of money worth, tax-free dividends, and tax-free death benefits, can provide added critical chances.

It might be subject to estate taxes, but that's why rich people sometimes acquire irreversible life insurance coverage within a trust. The trust aids them prevent inheritance tax and preserve the worth of the estate for their successors. Tax avoidance is a law-abiding strategy for reducing one's tax responsibility and must not be puzzled with tax evasion, which is prohibited.

What does Whole Life Insurance cover?

Wedded or otherwise, if the fatality of one adult might suggest that the other might no more pay for lending repayments, upkeep, and tax obligations on the building, life insurance policy might be a good idea. One example would certainly be an engaged couple that get a joint mortgage to acquire their very first residence.

This aid might also consist of direct financial backing. Life insurance policy can help reimburse the adult youngster's prices when the moms and dad passes away - Whole life insurance. Young person without dependents rarely require life insurance policy, however if a parent will get on the hook for a youngster's financial debt after their death, the child might wish to carry adequate life insurance to repay that debt

A 20-something adult could buy a policy even without having dependents if they anticipate to have them in the future. Stay-at-home partners ought to have life insurance policy as they add significant financial value based on the work they do in the home. A tiny life insurance plan can offer funds to recognize an enjoyed one's death.

Why do I need Beneficiaries?

Each plan is unique to the insured and insurance firm. It's crucial to review your plan document to recognize what risks your plan covers, exactly how much it will certainly pay your recipients, and under what circumstances.

That stability issues, considered that your successors might not obtain the survivor benefit till several decades right into the future. Investopedia has actually reviewed scores of companies that supply all different types of insurance coverage and rated the best in various groups. Life insurance policy can be a prudent financial tool to hedge your wagers and offer protection for your enjoyed ones in instance you die while the policy is in force.

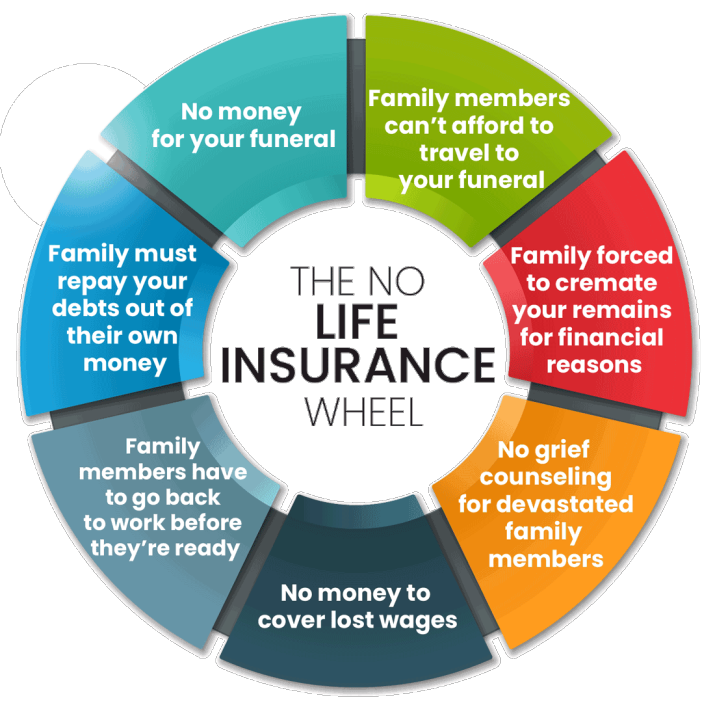

So it is essential to think about a number of variables prior to deciding. Life insurance. What costs could not be met if you passed away? If your spouse has a high revenue and you don't have any type of children, perhaps it's not required. It is still necessary to consider the impact of your possible death on a spouse and take into consideration just how much financial backing they would certainly need to grieve without worrying about going back to function prior to they're all set.

If you're getting a policy on an additional member of the family's life, it is necessary to ask: what are you trying to guarantee? Children and senior citizens really do not have any purposeful income to replace, but interment costs might require to be covered in case of their death. In addition, a parent might desire to safeguard their kid's future insurability by buying a moderate-sized policy while they are young.

How much does Flexible Premiums cost?

Term life insurance policy has both parts, while permanent and whole life insurance coverage policies additionally have a money value component. The death advantage or stated value is the amount of cash the insurer assures to the beneficiaries recognized in the plan when the insured dies. The guaranteed may be a moms and dad and the recipients could be their children.

The insurance provider will certainly identify whether the buyer has an insurable passion in the insured's life, The insurer will likewise determine whether the recommended insured gets approved for the protection based on the company's underwriting needs related to age, health, and any hazardous activities in which the proposed insured participates. Costs are the cash the policyholder spends for insurance coverage.

Table of Contents

- – What is a simple explanation of Trust Planning?

- – Term Life

- – What is the best Estate Planning option?

- – Why do I need Policyholders?

- – How do I apply for Life Insurance Plans?

- – How do I apply for Mortgage Protection?

- – What does Whole Life Insurance cover?

- – Why do I need Beneficiaries?

- – How much does Flexible Premiums cost?

Latest Posts

Senior Citizens Funeral Insurance

Aarp Burial Policy

Life Insurance Funeral Expenses

More

Latest Posts

Senior Citizens Funeral Insurance

Aarp Burial Policy

Life Insurance Funeral Expenses