All Categories

Featured

Table of Contents

Insurer won't pay a minor. Rather, consider leaving the cash to an estate or depend on. For more thorough info on life insurance coverage get a copy of the NAIC Life Insurance Policy Buyers Overview.

The internal revenue service puts a limit on exactly how much cash can go right into life insurance costs for the policy and just how swiftly such costs can be paid in order for the policy to keep every one of its tax benefits. If specific restrictions are gone beyond, a MEC results. MEC policyholders might undergo tax obligations on circulations on an income-first basis, that is, to the level there is gain in their policies, in addition to penalties on any type of taxable quantity if they are not age 59 1/2 or older.

Please note that impressive financings build up passion. Income tax-free treatment also thinks the financing will at some point be satisfied from income tax-free death advantage profits. Financings and withdrawals decrease the plan's cash money value and survivor benefit, may trigger particular plan advantages or riders to become not available and might raise the opportunity the policy might lapse.

4 This is supplied via a Long-lasting Treatment Servicessm rider, which is available for an added cost. In addition, there are constraints and limitations. A client may certify for the life insurance policy, however not the rider. It is paid as a velocity of the survivor benefit. A variable universal life insurance agreement is an agreement with the primary objective of supplying a death advantage.

How do I choose the right Cash Value Plans?

These portfolios are carefully handled in order to satisfy stated financial investment objectives. There are fees and costs related to variable life insurance policy agreements, including death and danger charges, a front-end tons, administrative costs, investment administration charges, abandonment fees and costs for optional cyclists. Equitable Financial and its affiliates do not give legal or tax suggestions.

Whether you're beginning a family members or marrying, people generally begin to consider life insurance policy when somebody else begins to depend upon their capability to make an income. And that's wonderful, since that's exactly what the survivor benefit is for. But, as you find out more regarding life insurance policy, you're most likely to locate that many plans for example, entire life insurance policy have greater than just a death advantage.

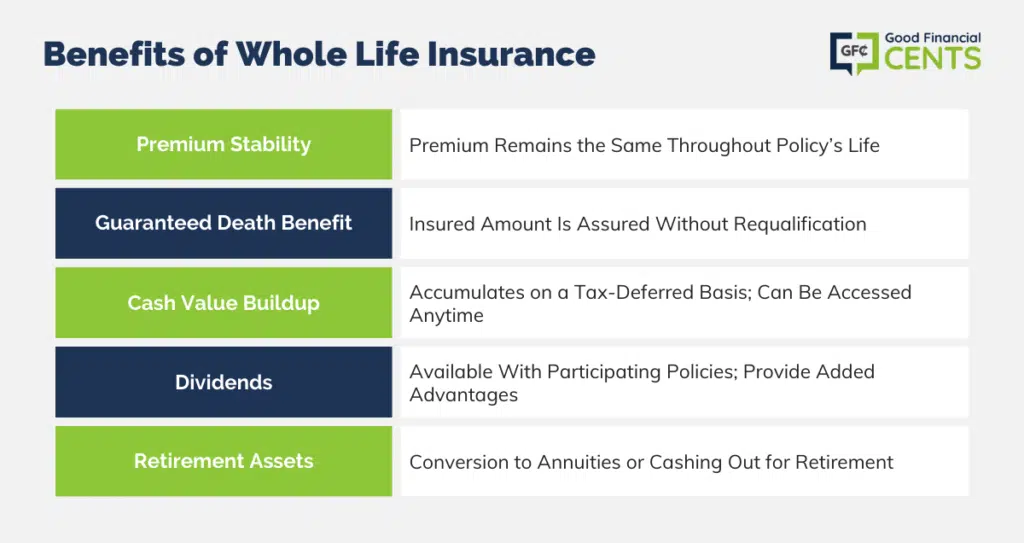

What are the benefits of whole life insurance coverage? One of the most enticing advantages of acquiring a whole life insurance coverage policy is this: As long as you pay your costs, your death benefit will certainly never end.

Believe you do not need life insurance coverage if you do not have children? There are lots of benefits to having life insurance coverage, also if you're not sustaining a family.

What are the benefits of Term Life Insurance?

Funeral expenditures, funeral expenses and medical bills can add up. Permanent life insurance is readily available in different quantities, so you can select a death benefit that satisfies your requirements.

Determine whether term or permanent life insurance is right for you. As your individual situations modification (i.e., marriage, birth of a kid or job promotion), so will certainly your life insurance coverage needs.

Generally, there are 2 types of life insurance policy plans - either term or permanent plans or some mix of both. Life insurance firms offer different forms of term strategies and standard life policies as well as "passion delicate" products which have actually ended up being much more common considering that the 1980's.

Term insurance policy offers protection for a given period of time. This period can be as short as one year or offer protection for a particular number of years such as 5, 10, two decades or to a specified age such as 80 or in some situations up to the oldest age in the life insurance policy mortality tables.

Where can I find Term Life?

Currently term insurance rates are very affordable and amongst the least expensive historically skilled. It should be noted that it is a widely held idea that term insurance is the least costly pure life insurance policy protection offered. One needs to evaluate the plan terms carefully to make a decision which term life options are suitable to fulfill your particular conditions.

With each new term the costs is increased. The right to restore the plan without evidence of insurability is an important advantage to you. Or else, the threat you take is that your wellness might weaken and you might be unable to obtain a policy at the same prices and even in all, leaving you and your beneficiaries without coverage.

The size of the conversion period will certainly differ depending on the type of term plan bought. The premium rate you pay on conversion is usually based on your "current acquired age", which is your age on the conversion day.

Under a degree term policy the face quantity of the policy continues to be the very same for the entire period. Usually such plans are marketed as home mortgage protection with the quantity of insurance coverage lowering as the equilibrium of the home loan lowers.

How can I secure Death Benefits quickly?

Commonly, insurance providers have not had the right to transform premiums after the plan is offered. Given that such plans might continue for years, insurance companies should make use of traditional mortality, passion and expenditure price quotes in the premium calculation. Flexible costs insurance, however, enables insurance companies to use insurance at lower "present" premiums based upon much less conventional assumptions with the right to change these costs in the future.

While term insurance coverage is made to offer protection for a specified period, long-term insurance policy is designed to supply coverage for your whole life time. To maintain the premium rate level, the premium at the more youthful ages exceeds the real expense of security. This extra premium builds a reserve (cash money value) which aids spend for the plan in later years as the cost of defense surges above the premium.

Under some plans, costs are required to be paid for a set number of years. Under various other policies, premiums are paid throughout the policyholder's lifetime. The insurance provider invests the excess costs dollars This sort of policy, which is often called cash worth life insurance policy, generates a financial savings aspect. Money values are critical to a permanent life insurance policy plan.

Latest Posts

Senior Citizens Funeral Insurance

Aarp Burial Policy

Life Insurance Funeral Expenses